Short Waiting for the end of the correction. IBEX 35

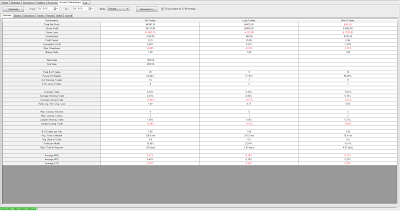

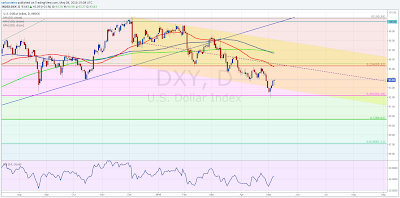

When everybody talk about to buy it's time to sell, last week Golman Sach, Merrill Lynch, Morgan Stanley and many others has said that we had see the botton. So, from my point of view its clair. It's time to look for short opportunities, between alls one of the weakest is the IBEX 35, benchmark index of the spanish market.With a potencial gain around 14% on short termes and 45% in the long termes. A close below 6.600 is the first signal to get short about a Stop above 7.230 points. Today we have the first clue in the intraday chart, we wait the confirmation with a close below 6.600 point to get short in the market. Take care and good week in the markets!!!